What do you do when you want to trade a new product but your trading and risk systems don’t support it? Add a parallel system and lose full visibility of your portfolio? Or book placeholder trades and rely on proxy valuations and risk assessments?

Innovating within your trading and investing businesses, such as structured products with customized returns, often brings difficult decisions:

- Can you afford to wait for vendors to add official support to their risk management products before you start executing trades? Or worse, the vendor is no longer adding new features?

- Do you need to model and risk manage some other way in the interim, such as complex and fragile spreadsheets?

- Are you able to see a consistent and consolidated view of your positions, across trading, sales, risk management, operations, and compliance?

Exploring Beacon’s Financial Object Hierarchy

One of the core foundations of Beacon is an open and customizable Financial Object Hierarchy. This capability enables customers to quickly and easily add new instruments and pricing models to their system. Instruments are a thorough representation of the contractual parameters of a product, such as a security or a derivative. New instruments immediately slot into existing applications, analytics, and reports, for pre-trade, post-trade, and what-if analysis across the lifecycle of product development, testing, and production deployments.

Example: Adding a barrier reverse convertible

Let’s go through the steps to add a new investment type to your product offering.

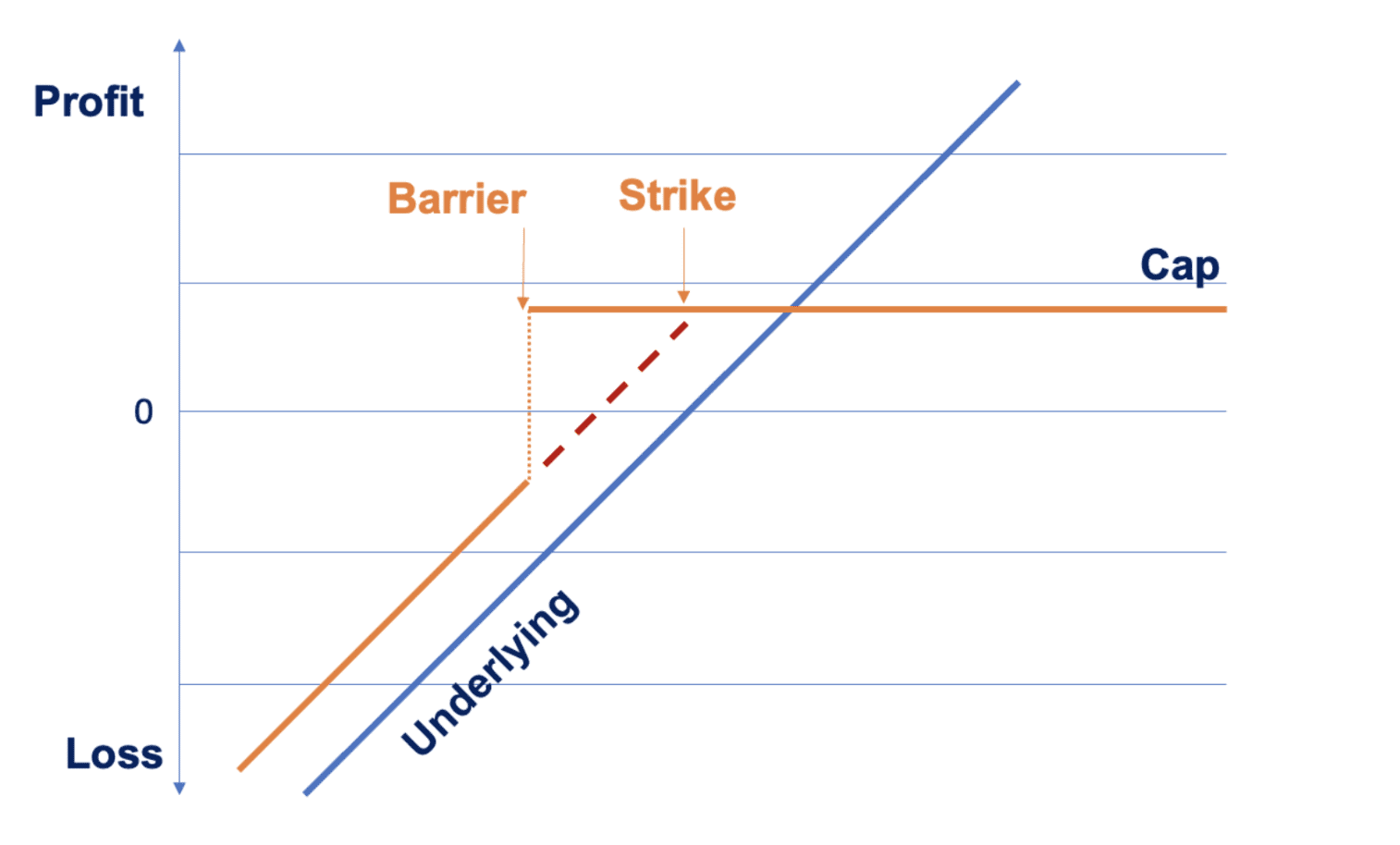

Start by identifying what contractual data you need to represent each offering of this product type: market underlier, maturity date, strike price, barrier level, and cap.

Next, determine how to value this payoff. The terminal payoff is illustrated above, but prior to expiry you have extrinsic value according to the dynamic properties of the market underlier.

There are really just two steps here:

- First you choose (or implement) a valuation model. You can:

- Reuse a standard model already included in Beacon, if applicable

- Customize existing models with the included developer environment

- Add proprietary ones from your quantitative teams

Beacon’s toolkit makes it easy for quantitative developers to incorporate and test valuation models written in Python and other languages, measure performance, stress test for compliance, and manage change control.

2. Then you connect your model to relevant market data (from the market and data layers of the Financial Object Hierarchy), and the contractual terms (from the instrument)

The data layer and Beacon’s dependency graph take care of recalculating valuations when your market data changes, which enables rapid sensitivity analyses and risk calculations across the book or portfolio.

Reusing existing logic makes this part easier. Building blocks such as calibrated volatility models and yield curve construction are included with the platform. These provide the necessary inputs to your pricing model, along with underlying market data price points for spot, forward, and price history (important for checking barriers), all supported by Beacon’s time-traveling data store.

Evolving and maturing instruments

Conceptually, when a Barrier Reverse Convertible hits the barrier, it becomes a Reverse Convertible. In Beacon, this descriptive behavior has a functional equivalence. Through our lifecycle interface it is straightforward to include the necessary business-logic that automates one instrument evolving or transforming into another. History is preserved, so you can always see what you started with, but it is beneficial for reporting purposes to see what product remains when barriers are no longer active. It’s also beneficial for computational efficiency: reverse convertibles are simpler to compute than their barrier alternatives.

Extensibility – three is the magic number

With Beacon’s Financial Object Hierarchy, three related elements of a portfolio and risk management system are readily extensible and interoperable: Instruments, Markets, and Reports.

- New instruments can be traded on existing markets and included in existing analytics and reports

- New markets can be used to trade existing instruments and included in existing analytics and reports

- New reports and analytics can be applied to all or part of your portfolio and across all markets

Or sometimes four is the magic number

Going one step further, the risk and valuation methodologies you use today might not be the ones you want next year. And if you change valuation methodologies, you need to carefully manage that change with parallel testing before moving to production, side-by-side comparisons of different methodologies, and the ability to reproduce previous results for regulatory or accounting purposes.

With Beacon’s configurable pricing layer, you can substitute a different pricing model for the current default on a temporary or case-by-case basis. You can also set up distinct environments that run against the same data but use different models for side-by-side comparisons. Or use Beacon’s time-travel capabilities to assign different configurations to different pricing dates, ensuring reproducibility of past results. Most importantly, changes are explicit and governed by your business logic and controls, keeping administrators and risk managers in command. This minimizes the possibility of user error, such as executing deals with the wrong pricing model or reporting incorrect or inconsistent portfolio risks.

Accelerating financial innovation with transparency

Beacon’s transparent source license covers the full platform, making it easy to innovate throughout the lifecycle of your portfolio. New instruments can access existing market and data interfaces, be included in deals and portfolios, and analyzed or reported on by applications. Customers can also readily add or modify functions, such as volatility calculators or curve fitters, and applications such as proprietary risk analytics or position management. Risk analysis becomes clearer and more consistent across portfolios and asset classes, providing valuable and timely information in volatile environments.

To learn more about how Beacon can help your company improve risk management and portfolio performance, contact us for a demo or watch a recorded webinar on engineering a new financial instrument. And stay tuned for an upcoming webinar by Beacon co-founder Mark Higgins on this topic.