Inflation and geopolitical issues identified as biggest overall risks

Investment analysts have greater concerns about IT failure

London January 13, 2025 As hedge funds navigate global risks and volatile markets, executives are concerned about maintaining control of model and algorithm changes and building a greater understanding of overall exposures, new global research* by Beacon Platform Inc. shows.

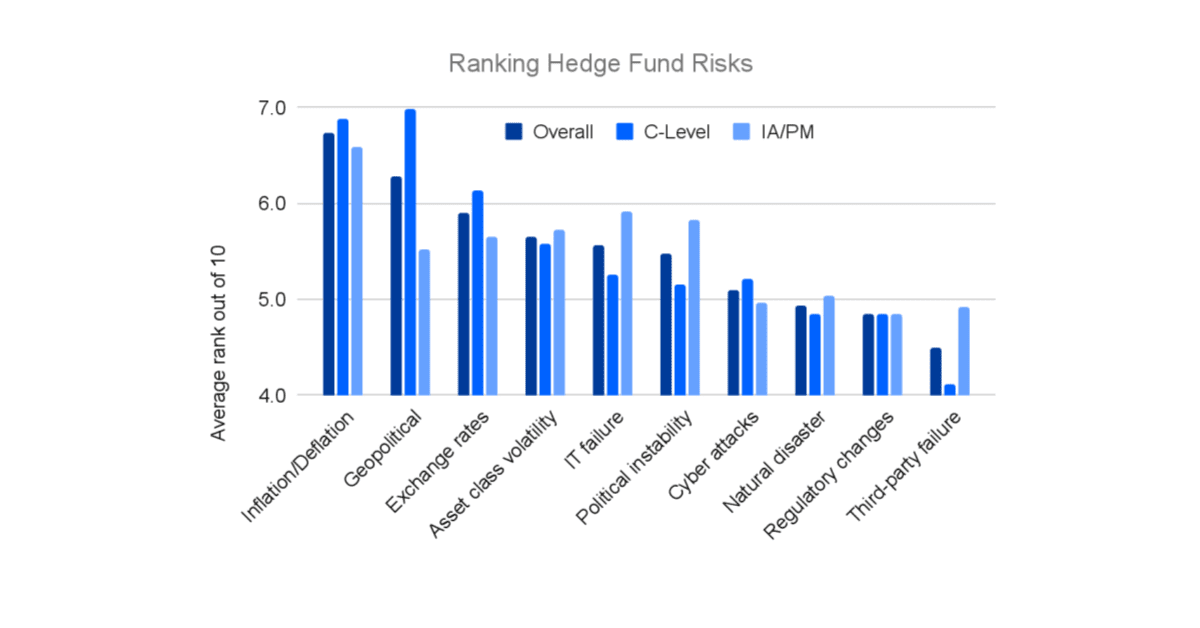

Ranking the biggest risks

The surveyed hedge fund executives were asked to rank a list of 10 key risks facing hedge funds today. Overall, the group considered inflation or deflation and geopolitical issues to be the top 2 risks they were facing, followed by exchange rates and asset class volatility. And they were least concerned with third-party failures and regulatory changes.

IT failure was a notable difference between the C-Suite respondents and their investment analysts (IA) and portfolio managers (PM), with the latter group ranking it as their second biggest risk. Furthermore, the largest funds, with assets under management between $25 and $50 billion, were much more concerned about inflation or deflation (8.7/10) and geopolitical instability (8.1/10), rating these issues 30% higher than the overall group.

The study with 100 senior hedge fund executives in the US, UK, Germany, Switzerland, France, Italy, Sweden, Norway, and Asia responsible for a collective $901 billion assets under management found the top risks to be fairly evident. But what do funds need to do to improve their risk management capabilities and build greater resilience into their systems in the face of increased risk factors and volatility?

Rating risk management challenges and hedge fund capabilities

The group was asked to rank a key set of risk management challenges faced by hedge funds, and then to rate their own systems against each challenge. Control of models and algorithms was a clear leader as the biggest challenge, followed by understanding the fund’s overall exposure and having minimal latency when getting results from complex risk calculations.

When rating their own systems, on average the group thought they were best at getting coverage of all traded products in the same system and worst at calculation latency.

Concerns and capabilities vary by size

As hedge funds increase in size, it is not surprising that their top challenges and capabilities will change. The smallest funds surveyed, with less than $1 billion in assets under management, were most concerned with accuracy, exposure, and adaptability as they build and improve their risk management systems. The middle group, with assets between $1 billion and $10 billion, shift their focus to model control, calculation latency, and overall system resilience, as they work to handle more models and run calculations for a greater variety and complexity of assets. And the biggest funds, with assets between $10 billion and $50 billion, want to ensure that they are including full coverage of their broad portfolio of assets, are calculating accurate and appropriate information about their exposures, and are getting results from these complex calculations in time to be actionable.

Kirat Singh, CEO and Co-Founder, Beacon Platform Inc. said: “As geopolitical risks continue to grow and bring with them renewed threats of inflation or deflation and increased volatility, our research shows that hedge fund executives are turning their attention towards the capabilities that they will need to prosper in this environment. As a provider of risk management systems, our job is to make sure that hedge funds can, in a timely manner, figure out where their edge is, trade the risks that they want to take, and manage the portfolio lifecycle. Because if you don’t understand your risks, you can’t take the right risks.”

The Beacon executive team, selected partners, and interested clients will be exploring this research and discussing hedge fund issues at the company’s annual Inspire conference, “The Power of Informed Risk: Building Resilience In Volatile Markets”, to be held in London on April 3rd, 2025.