Beacon Platform Inc. research identifies the most important risk management capabilities

But not many hedge fund executives describe their existing systems as “Excellent”

London December 4, 2024 New global research by Beacon Platform Inc. shows that advanced technologies and system integrations are playing vital roles as hedge funds strive to improve their visibility in an increasingly risky and volatile investment environment.

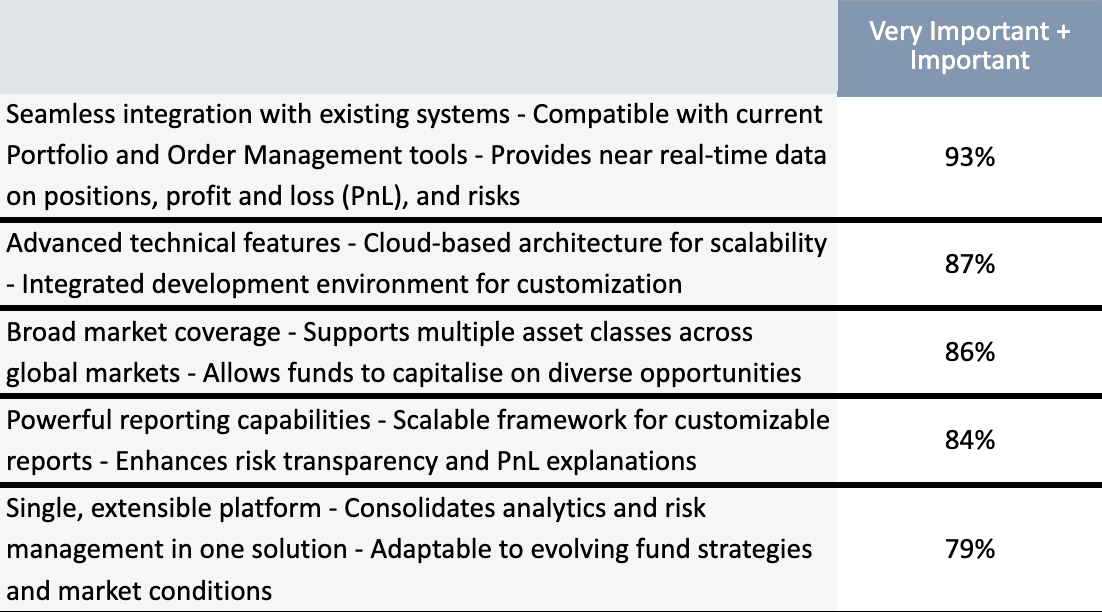

The surveyed executives were asked to rate the importance of five essential risk management capabilities. Almost all of those surveyed (93%), described seamless integration with existing systems, including compatibility with current tools and near-real-time data on positions, PnL, and risk, as an important or very important source of competitive advantage of their systems. Advanced technical features, such as cloud-based architecture for scalability and integrated development environment for proprietary models and customization, were the next most important (87%).

Table 1: How important are these aspects of modern portfolio analytics and risk management systems as a source of competitive advantage?

To identify the leading funds, executives were then asked to rate the competitiveness of their existing systems. Surprisingly, the study by Beacon Platform Inc., with 100 executives in the US, UK, Germany, Switzerland, France, Italy, Sweden, Norway, and Asia responsible for a collective $901 billion assets under management, found that just 20% of those surveyed describe the competitive edge gained from their portfolio analytics and risk management system as “Excellent”.

Systems integration is leading to greater success.

Integrated systems are playing an important role in competitiveness and risk visibility. Half of those who rated their competitive edge as “Excellent” said their systems were extremely well integrated, compared with just 5% of those who had a “Good” competitive rating and none of the “Average” funds. Similarly, 60% of the group with “Excellent” risk visibility said their systems were extremely well integrated, compared with 10% or less of the “Good” and “Average” funds.

Table 2: System integration and competitive edge

Table 3: System integration and visibility of risks

Increased technology investments are paying off.

All of the funds who described their current system as excellent were more likely to have increased their risk management budget dramatically over the past 2 years (55%), compared to 13% of those who describe their system as good, and just 6% of those who rate it average.

Table 4: Competitiveness and risk management budget

As a result, funds in the “Excellent” group have experienced greater improvements in risk visibility, with 60% saying visibility has improved dramatically over the past 2 years, compared to less than 10% of those rating their system as good or average.

Table 5: Competitiveness and visibility of risks

Technology is seen as a strong component of competitive advantage and funds are not being complacent about their capabilities. Even with high levels of system integration, more than 9 out of 10 (92%) of the group said that they were still spending too much or far too much time consolidating and integrating data from multiple sources. Investment evaluation and due diligence was selected by 81%, and 79% identified aggregating and measuring risk across strategies, desks, and at the firm or fund level as taking too much time. Yet those rating their system’s competitiveness as excellent were more likely to say these processes were taking too much time than those who rated their system good or average.

Asset Tarabayev, Chief Product Officer at Beacon Platform Inc. said: “Hedge funds clearly understand that data and systems integration are essential components of both risk visibility and competitive advantage—even if only 1 in 8 think that their current systems are extremely well integrated. ”

About Beacon

Beacon is a financial technology firm that provides everything quantitative developers need to rapidly build, test, deploy and share trading and risk applications, analytics and models. Developed by a team with unmatched financial markets experience, Beacon’s open platform includes the apps, tools and infrastructure firms need to migrate their software and infrastructure to the cloud, manage risk across all asset classes, and focus on building innovative strategies that provide a competitive edge. For more information visit www.beacon.io